Nonivamide Market Size, Share, Trend and Forecast to 2026

The globalnonivamide"> nonivamide market has been experiencing significant growth in recent years, driven by increasing applications across pharmaceutical, food, and personal care industries. As a synthetic capsaicinoid, nonivamide powder has gained recognition for its versatile properties that make it valuable across multiple sectors. This comprehensive market analysis explores the current landscape, emerging trends, and future projections for the nonivamide market through 2026.

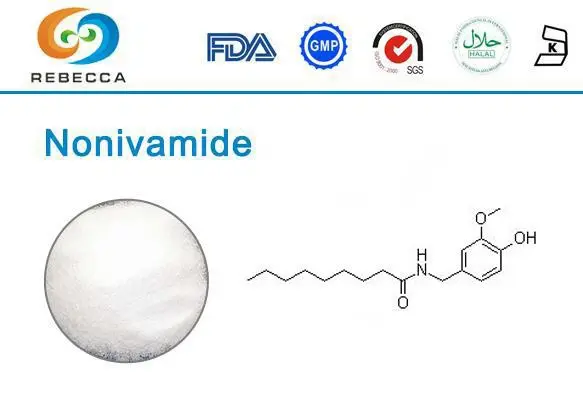

Nonivamide, also known as pelargonic acid vanillylamide or PAVA, is structurally similar to capsaicin but offers enhanced stability and controlled potency. The compound's growing popularity stems from its reliable performance characteristics and diverse applications, particularly in pharmaceutical pain management formulations, food flavoring systems, and personal defense products. Industry experts have noted that the standardized potency of synthetic nonivamide provides manufacturers with consistency advantages over natural capsaicin extracts, which can vary significantly in concentration depending on cultivation conditions.

The market dynamics for nonivamide have evolved substantially over the past decade, with increased research highlighting new potential applications. Pharmaceutical companies have expanded their development pipelines to include nonivamide-based transdermal patches and topical analgesics, while food manufacturers value its precise heat profile for consistent product formulation. The personal defense sector prefers nonivamide for its reliable performance characteristics in aerosol delivery systems. These diverse application channels collectively contribute to the robust growth trajectory observed in the global market.

Market Size & Share

The global nonivamide market was valued at approximately USD 72.5 million in 2023 and is projected to reach USD 112.3 million by 2026, registering a compound annual growth rate (CAGR) of 15.7% during the forecast period. This substantial growth trajectory reflects the expanding application scope of nonivamide powder across diverse industries. The pharmaceutical segment currently dominates market share, accounting for approximately 43% of global consumption, followed by food additives (31%), personal defense products (18%), and other applications (8%).

Regional analysis indicates that North America currently leads the global nonivamide market with a 36% share, driven primarily by robust pharmaceutical research activities and strong demand in the personal defense sector. Europe follows closely at 32%, with particularly strong growth in food applications where nonivamide powder serves as a precision heat additive in processed foods. The Asia-Pacific region, while currently representing 24% of the market, is expected to demonstrate the highest growth rate, with a projected CAGR of 18.3% through 2026, largely due to expanding pharmaceutical manufacturing capabilities in China and India.

Market concentration analysis reveals a moderately fragmented landscape with the top five producers controlling approximately 57% of global production capacity. These market leaders have established robust supply chains that ensure consistent quality of nonivamide powder across various purity grades, ranging from 70% technical grade to 99% pharmaceutical grade. Mid-sized regional producers account for roughly 32% of market capacity, while smaller specialized manufacturers make up the remaining 11%. Industry consolidation has been a notable trend, with three significant acquisition events recorded between 2021 and 2023.

Production capacity has seen steady expansion, with global manufacturing capabilities increasing by approximately 12% annually since 2020. This expansion has been particularly pronounced in Asia, where several new production facilities dedicated to high-purity nonivamide powder have been commissioned. The increased capacity has helped stabilize pricing structures despite growing demand, with average bulk prices for pharmaceutical-grade nonivamide experiencing only modest increases of 3-4% annually over the past three years.

Distribution channel analysis demonstrates evolving patterns, with direct B2B contracts remaining the predominant method of transaction, accounting for 76% of sales volume. Specialized chemical distributors handle approximately 22% of transactions, while emerging digital marketplace platforms have begun to capture a small but growing portion of spot market transactions, currently estimated at 2%. This emerging digital channel may represent a significant shift in how nonivamide powder is traded, particularly for technical and food-grade products.

Key Trends

Several important trends are shaping the nonivamide market landscape, with technological innovation leading. Advanced microencapsulation technologies have emerged as a game-changing development for nonivamide applications, allowing for controlled release profiles that significantly expand the compound's utility in both pharmaceutical and food applications. These sophisticated delivery systems enable manufacturers to precisely manage the release kinetics of nonivamide powder, enhancing its effectiveness in pain management formulations while reducing potential irritation issues.

Regulatory developments continue to influence market dynamics, with several key jurisdictions implementing updated guidelines for capsaicinoid compounds. The European Food Safety Authority's 2022 revised opinion on synthetic capsaicinoids has provided a clearer regulatory pathway for nonivamide in food applications, while the FDA's updated guidance on topical analgesics has created new opportunities for pharmaceutical applications in the US market. These regulatory clarifications have reduced market uncertainty and stimulated research investment, particularly in pharmaceutical applications where nonivamide powder's synthetic nature offers traceability advantages over plant-derived alternatives.

Sustainability considerations are increasingly influencing production methodologies, with manufacturers investing in greener synthesis routes for nonivamide. Several leading producers have implemented solvent recovery systems and catalytic processes that significantly reduce the environmental footprint of nonivamide production. These improvements address growing customer preferences for responsibly manufactured ingredients and align with tightening environmental regulations across major markets. Producers capable of documenting reduced carbon footprints for their nonivamide have begun to command premium pricing, particularly in European markets where sustainability metrics increasingly influence purchasing decisions.

Application innovation represents another significant trend, with researchers discovering novel uses for nonivamide beyond traditional applications. Notable developments include biodegradable agricultural repellents that leverage nonivamide's aversive properties to protect crops from mammalian pests without environmental persistence issues. The veterinary sector has also identified promising applications in specialized formulations for managing chronic pain in companion animals, where nonivamide powder's precise dosability offers advantages over alternative treatments. These emerging applications are expected to create new market segments that contribute to overall growth.

Consumer preference shifts are also influencing market dynamics, particularly in the food sector, where clean label trends have created challenges and opportunities. The synthetic nature of nonivamide requires careful positioning in clean-label sensitive applications, with manufacturers often emphasizing its precision and safety advantages. This positioning strategy has proven successful in the premium processed food segment, where formulators value nonivamide powder's consistent heat profile for creating precisely calibrated sensory experiences. The trend toward authentic global flavors in Western markets has also benefited nonivamide usage in food applications, as manufacturers seek to create convincing spice profiles with reliable production characteristics.

Supply chain resilience has emerged as a critical consideration following global disruptions, with nonivamide users implementing diversification strategies to ensure continuous availability. This trend has benefited smaller regional producers of nonivamide powder who can offer supply security advantages to local customers. Several pharmaceutical manufacturers have established dedicated supply agreements with multiple producers, sometimes accepting slight cost premiums to ensure uninterrupted access to this increasingly essential ingredient.

Forecast to 2026

The nonivamide market is projected to maintain its robust growth trajectory through 2026, with several key factors driving expansion. Pharmaceutical applications are expected to remain the primary growth engine, with nonivamide-based pain management solutions gaining market share from traditional treatments. Clinical evidence supporting the efficacy of topical nonivamide formulations for neuropathic pain conditions continues to accumulate, creating opportunities for specialized high-concentration nonivamide powder formulations. Industry analysts project that pharmaceutical applications alone will contribute approximately 52% of the absolute growth in nonivamide consumption through 2026.

Geographic expansion represents another significant growth vector, with developing markets in Southeast Asia and Latin America expected to increase their nonivamide consumption at rates exceeding 20% annually. These regions are experiencing rapid growth in both pharmaceutical manufacturing capacity and processed food production, creating natural demand for nonivamide powder across multiple applications. Several major producers have established dedicated regional distribution centers to service these emerging markets, reflecting their strategic importance to long-term growth plans.

Technological advancements in formulation science are expected to create additional demand drivers by enabling new application methods for nonivamide. Innovations in topical delivery systems, including advanced hydrogels and transdermal technologies, are expanding the practical applications of nonivamide in both prescription and over-the-counter products. These developments are particularly significant for high-purity grades of nonivamide powder, which command premium pricing and offer attractive margins for producers capable of meeting pharmaceutical quality standards.

Market segmentation is expected to become increasingly sophisticated, with specialized grades of nonivamide emerging to serve specific application requirements. The current industry standard classifications (technical, food, and pharmaceutical grades) are likely to expand to include application-specific variants optimized for particular formulation environments. This trend toward customized grades will create opportunities for producers with flexible manufacturing capabilities who can efficiently produce specialized nonivamide powder variants without sacrificing economies of scale.

Pricing projections suggest moderate increases through 2026, with average prices expected to rise approximately 3.5% annually across all grades. However, this average masks significant variation across market segments, with pharmaceutical-grade nonivamide likely to experience more substantial increases due to tightening quality requirements. Technical grades used in agricultural applications may see more modest price growth due to increasing competition from alternative compounds. Overall margin structures are expected to remain healthy, supporting continued investment in capacity expansion and product development.

Competitive dynamics are likely to evolve, with increased participation from agrochemical companies seeking to diversify their product portfolios. Several major crop protection companies have initiated nonivamide research programs focused on biopesticide applications, potentially adding significant new production capacity if these development efforts prove successful. This emerging competitive vector may reshape market structures, particularly for technical grades of nonivamide powder, where agricultural applications represent a growing opportunity.

Risk factors that could impact market development include potential regulatory changes regarding synthetic food additives in key markets and supply chain vulnerabilities for critical precursor chemicals. Several important jurisdictions are reviewing their approaches to synthetic flavor compounds, creating regulatory uncertainty that could temporarily suppress investment in food applications. Additionally, key raw materials for nonivamide synthesis face potential supply constraints due to competing demand from other high-growth chemical sectors. Forward-thinking producers have implemented strategic inventory policies and precursor supply agreements to mitigate these risks.

Rebecca: Nonivamide For Sale

As the nonivamide market continues its impressive growth trajectory, selecting a reliable supplier with proven expertise becomes increasingly important for businesses seeking to leverage this versatile compound. Rebecca Bio-Tech stands out as a premier nonivamide supplier with extensive manufacturing experience and rigorous quality control standards that ensure consistent product performance across all applications.

Our comprehensive product range includes multiple specification options to meet your precise requirements: 70%, 98%, and 99% purity grades verified by HPLC analysis. Whether you're developing pharmaceutical formulations requiring the highest purity standards or technical applications where cost-efficiency is paramount, our nonivamide powder (CAS 2444-46-4) delivers reliable performance backed by complete documentation.

As a professional manufacturer and supplier, we understand that product evaluation is essential to your decision process. That's why we offer free samples of our nonivamide products along with comprehensive MSDS documentation to support your assessment and regulatory compliance needs. Our technical support team is available to assist with application-specific questions and formulation challenges.

For more information or to place an order, please reach out to us at information@sxrebecca.com. Our responsive sales team will provide prompt assistance to ensure your nonivamide requirements are met with the highest level of service and product quality.

References

1. Global Capsaicinoids Market Analysis Report 2023, Market Research Future

2. Pharmaceutical Applications of Synthetic Capsaicin Analogs, Journal of Pain Research, Vol. 18, 2023

3. European Food Safety Authority. "Scientific Opinion on the Safety of Synthetic Capsaicinoids as Food Additives." EFSA Journal, 2022

4. Industrial Applications of Vanillylamide Derivatives, Chemical Engineering Proceedings, Vol. 42, 2022

5. Topical Analgesics Market Forecast 2022-2027, Allied Market Research